where do i pay overdue excise tax in ma

Visit their website here. Where do you pay late Motor Vehicle Excise taxes.

Online Bill Payment Town Of Dartmouth Ma

Drivers License Number Do not enter vehicle plate numbers.

. How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal. How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non. The city or town where the vehicle is principally garaged levies the excise and.

Please note all online payments will have a 45 processing fee added to your total due. All bills are based on the information in the RMV database. Find your bill using your license number and date of birth.

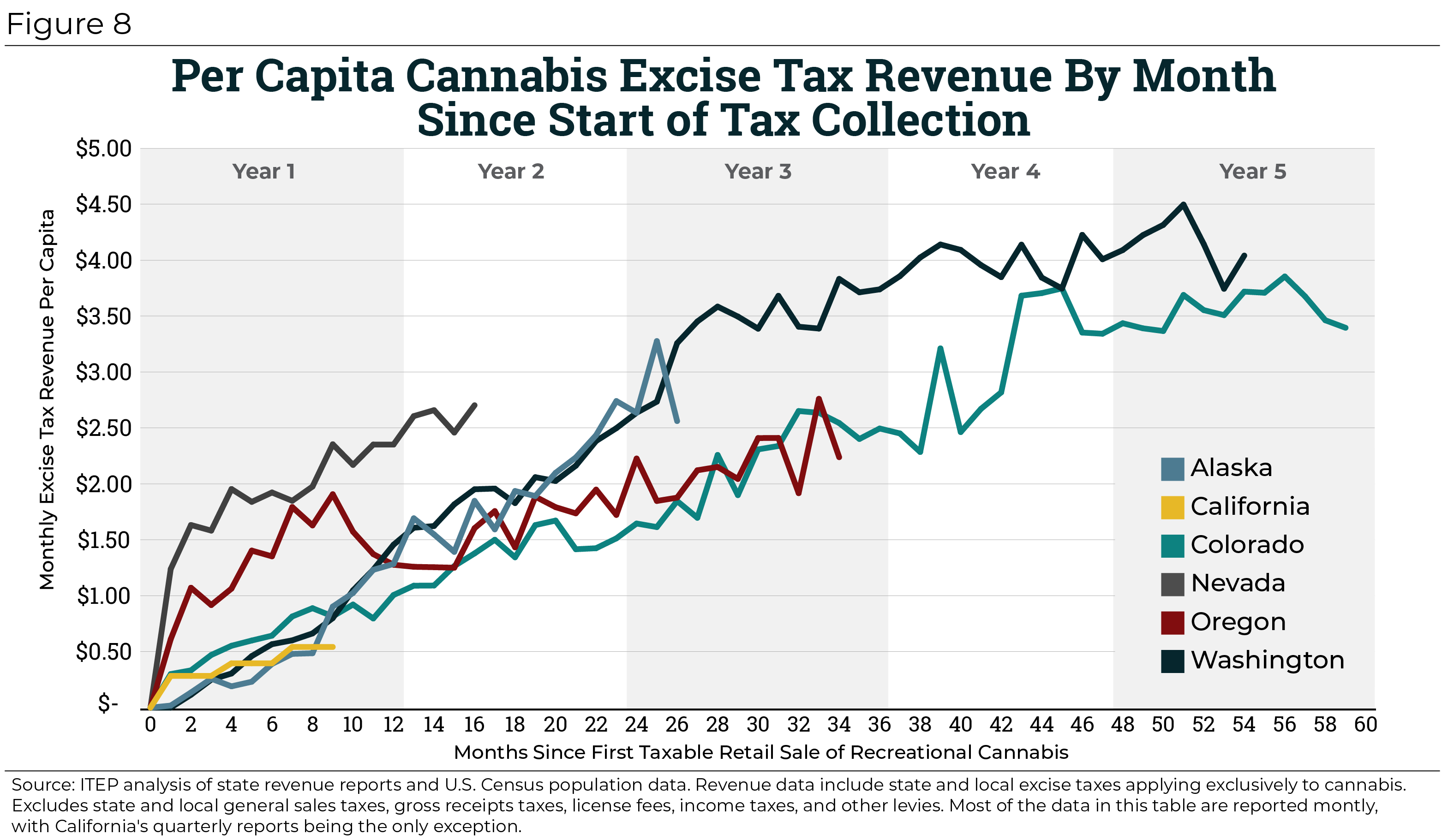

10 - Year 5. Ad Avalara excise tax solutions take the headache out of rate determination and compliance. Please contact the treasuercollectors office or our Deputy Collector Kelly and.

Effective August 1 2018Jefffery Jeffery no longer. TAX INQUIRES MUST EMAIL treasurersaugus-magov. You must file for abatement with the Athol Assessors office if you are entitled to abatement.

Get the ins and outs on paying the motor vehicle excise tax to your city or. 40 - Year 3. Tax information for income tax purposes must be requested in writing.

Hopedale MA 01747 508-473-9660. One of the greatest marvels of the marine world the Belize Barrier Reef runs 190 miles along the Central American countrys Caribbean coast. Please contact our Deputy Collector Jeffery Jeffery 137 Main Street Ware MA 01082-0720 or by phone at 413-967-9941.

Pay Delinquent Excise. Please contact the Town of Winchendon Assessors Office for abatement information. How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. Please note for new vehicles released in the calendar. This can take up to 90 days.

Its part of the larger Mesoamerican Barrier Reef. Massachusetts Property and Excise Taxes. Kelly Ryan Associates 3 Rosenfeld Dr.

You must pay the excise tax bill in full by the due date. We strongly encourage you to pay your Excise tax bills online or by dropping the check and bill in the outside dropbox on the circle driveway at Town Hall. When you register your motor vehicle or trailer you have to pay a motor vehicle and trailer excise.

Online Bill Pay for Real Estate Personal Property. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. Excise taxes are issued throughout the year when commitments are received from the Registry of Motor Vehicles.

WE DO NOT ACCEPT. Avalara solutions can help you determine excise tax and sales tax with greater accuracy. 25 - Year 4.

90 - Year 1 where the model year of vehicle is the same as the Excise Tax year 60 - Year 2. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor. THIS FEE IS NON-REFUNDABLE.

If you are unable to find your bill try searching by bill type. Online Payment Search Form. They also have multiple locations you can pay including Worcester RMV Leominster RMV and other locations listed on their website.

If you dont make your payment within 30 days of the date the City issued the excise. If you have not received an Excise Tax. Current Fiscal Year Tax Rate.

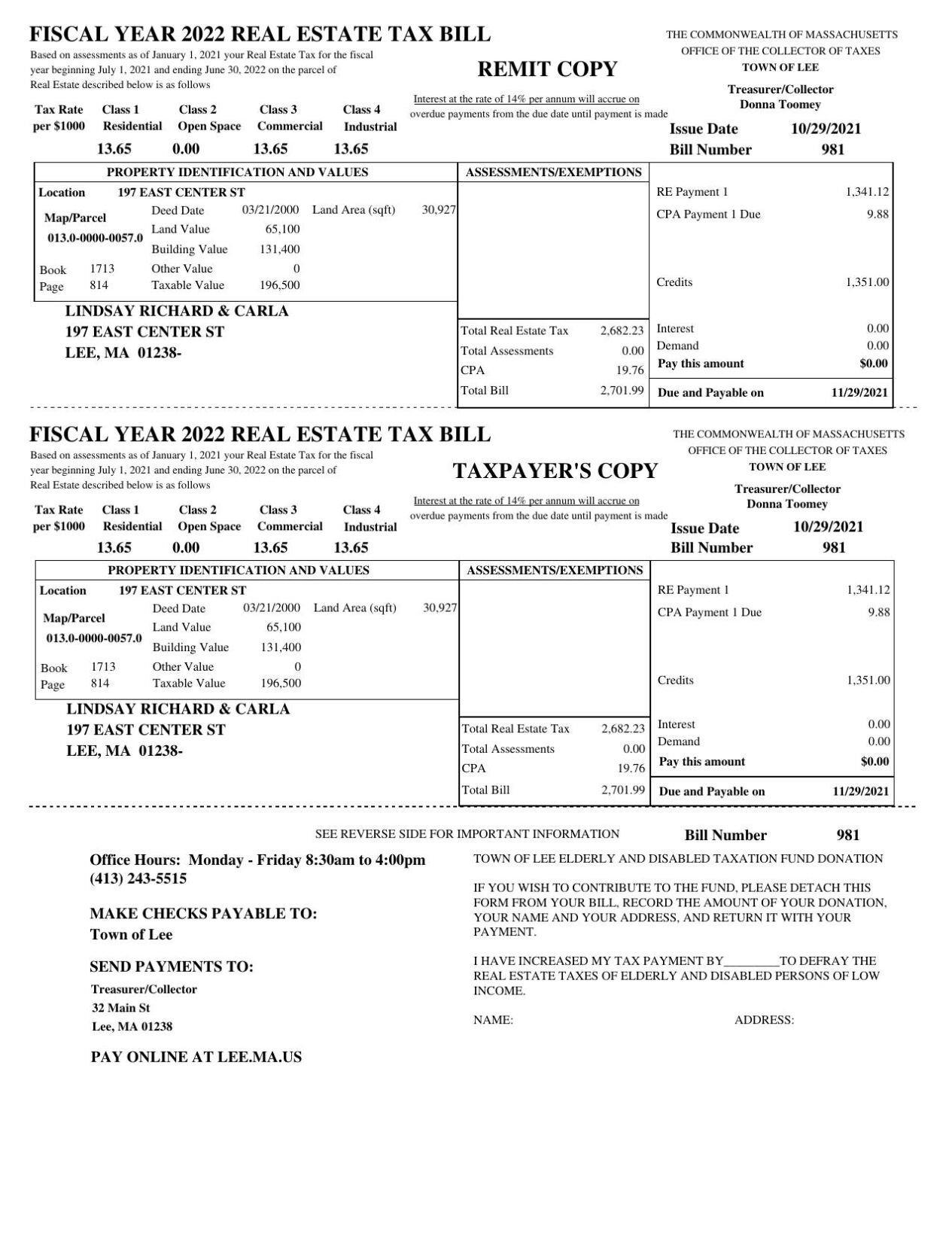

6 Things To Know About Your Property Tax Bill If You Own A Home In Berkshire County Local News Berkshireeagle Com

In A Market Where The Supply Curve Is Perfectly Inelastic How Does An Excise Tax Affect The Price Paid By Consumers And The Quantity Bought And Sold Why Quora

Motor Vehicle Excise Tax Wellesley Ma

Canadian Cannabis Producers Overdue Excise Taxes More Than Triple To Ca 52 Million

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Excise Tax Late Payment Notice Methuen Ma

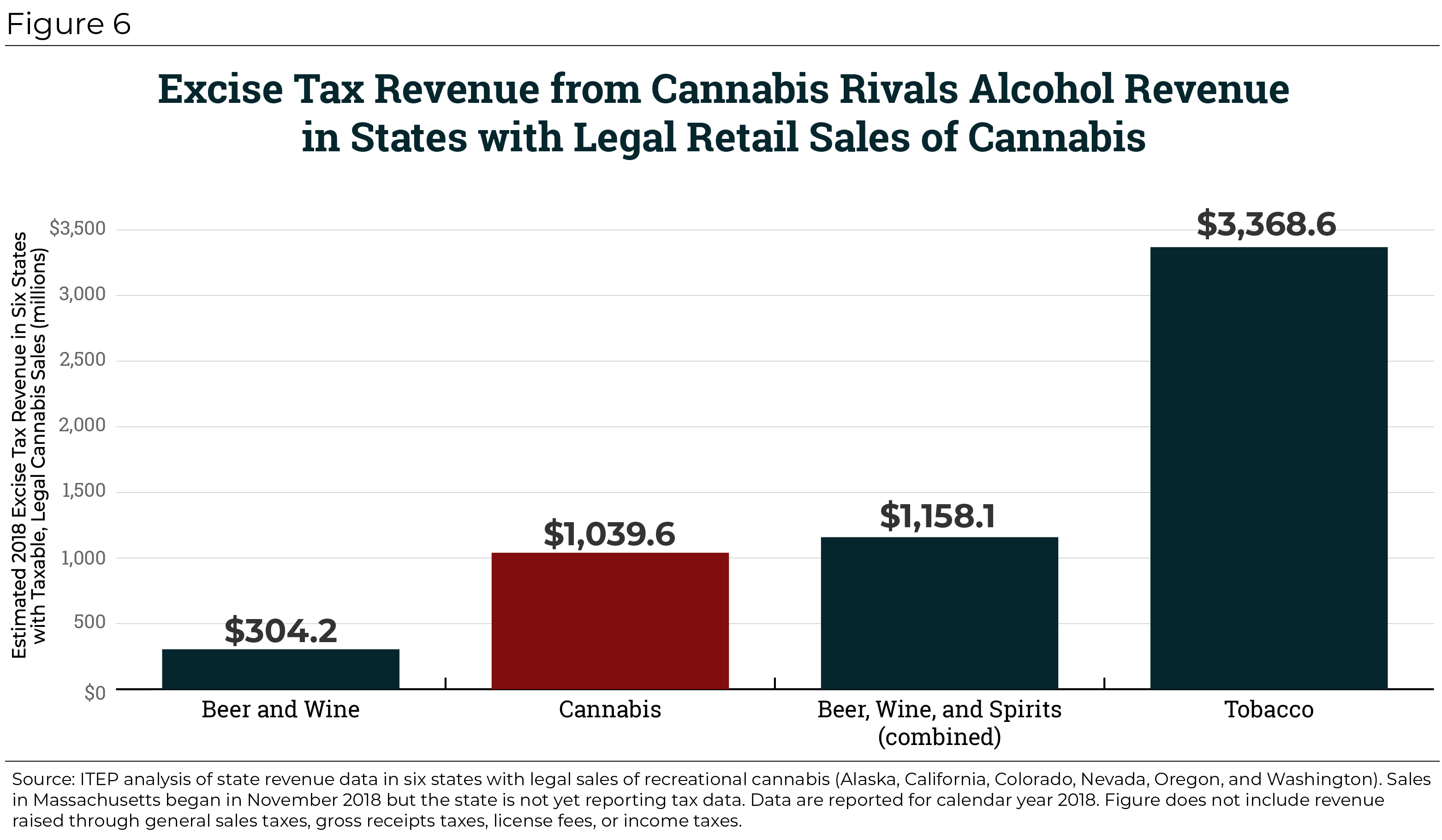

Marijuana Excise Taxes Outpace Alcohol In Massachusetts

Excise Tax Gloucester Ma Official Website

Town Of Fairhaven Collector S Office Reminder Excise Tax Bills Were Mailed On February 7 2019 And Are Due On March 8 2019 If You Have Not Received Your Bill Contact The Collector S

Characteristics Of Different Types Of Tobacco Excise Tax Structures Download Table

Distilled Spirits Excise Tax Rates Around The Globe Five X 5 Solutions

Edelstein Company Llp Tax Alert Massachusetts Enacts Elective Pass Through Entity Excise