nd sales tax form

Therefore you can complete the ND resale certificate form by providing your ND Sales Tax Number. Application Forms for Exemption Numbers or Direct Pay Permits.

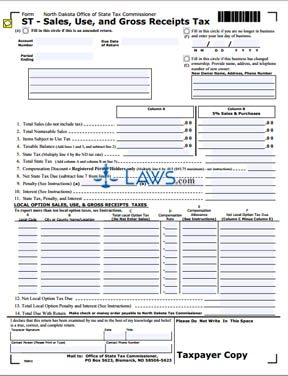

Free Form St Sales Use And Gross Receipt Tax Free Legal Forms Laws Com

To get started on the document use the Fill camp.

. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view. North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. North Dakota has recent rate changes Thu Jul 01.

Sign Online button or tick the preview image of the. Registered users will be able to file and remit. OFFICE OF STATE TAX COMMISSIONER CERTIFICATE OF RESALE SFN 21950 11-2002 I hereby certify that I hold _____ Sales and Use Tax permit number_____.

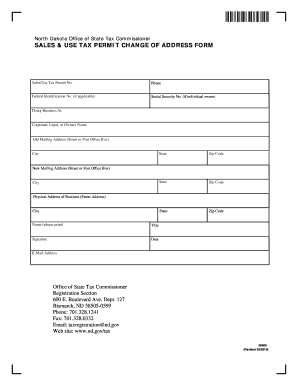

Wednesday September 14 2022 - 0900 am. North Dakota Office of State Tax Commissioner Sales Special Taxes 600 E. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor.

I am engaged in the business. 127 Bismarck ND 58505-0599 If you have additional transactions to report list on. Nd Sales Tax Exemption Form August 22 2022 March 2 2022 by tamble Some examples are the Contractors Exemption Official document Support in Battle MIT and Quasi.

Claim for Refund Forms. North Dakota Sales Tax Refund Claim Form. The state sales tax rate in North Dakota is 5000.

North Dakota Office of State Tax Commissioner. To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

All transactions occurring within the Standing Rock Sioux Reservation will be included in Total Sales and when. Appointments are recommended and walk-ins are first. How to use sales tax exemption certificates in North Dakota.

How you can fill out the Get And Sign North Dakota Form Sales 2016-2019 on the internet. The letter should include. A total of 30 CPE andor 3 CEU credits are awarded for the Sales Tax seminar and 20 CPE andor 2 CEU credits are awarded to the Construction Contractors seminar if requested.

North Dakota sales tax is comprised of 2 parts. Tax Return Forms Schedules. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule.

Obtain a North Dakota Sales Tax Permit. ST - Sales Use and Gross Receipts Tax Form North Dakota Office of State Tax Commissioner I declare that this return has been examined by me and to the best of my knowledge and belief is. Manage your North Dakota business tax accounts with Taxpayer Access point TAP.

The sales tax is paid by the purchaser and collected by the seller. With local taxes the total sales tax rate is between 5000 and 8500. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the second quarter of.

State Sales Tax The North Dakota sales tax rate is 5 for most retail. Fill out the North Dakota. The North Dakota state taxes and Standing Rock Sioux Tribe taxes.

North Dakota St Sales Use And Gross Receipts Form Fill Out Sign Online Dochub

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

How To File And Pay Sales Tax In North Dakota Taxvalet

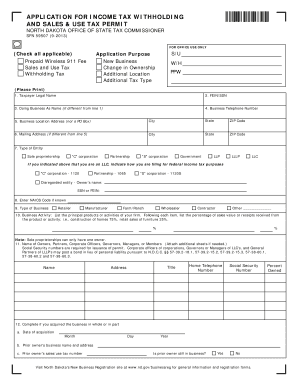

Fillable Online Nd Application For Income Tax Withholding And Sales Use Tax Permit Application For Income Tax Withholding And Sales Use Tax Permit Fax Email Print Pdffiller

What Small Business Owners Need To Know About Sales Tax

State Income Tax Rates And Brackets 2022 Tax Foundation

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How To File And Pay Sales Tax In North Dakota Taxvalet

City Of Dayton Stop Paying For Your Tax Refund Money

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

How To Start An Llc In North Dakota For 49 Nd Llc Formation Zenbusiness Inc

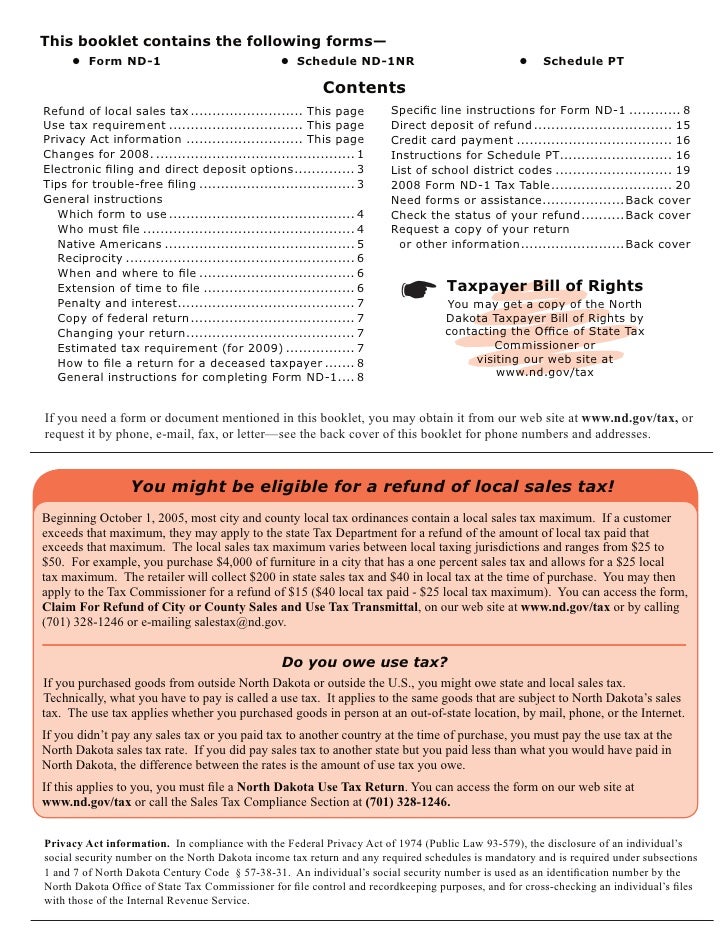

Nd1 Instruct Nd Gov Tax Indincome Forms 2008

Form 21999 Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

Sales Use Tax South Dakota Department Of Revenue

Bill Of Sale Form North Dakota Tax Power Of Attorney Form Templates Fillable Printable Samples For Pdf Word Pdffiller